Study Notes

Overview

Financial ratios are a cornerstone of the AQA GCSE Business specification (8132), particularly in Paper 2. They are the tools a business uses to analyse its own performance, turning raw numbers from financial statements into powerful insights. For candidates, mastering these ratios is not just about maths; it's about becoming a business analyst who can diagnose problems, justify decisions, and make strategic recommendations. Examiners are looking for candidates who can move beyond simple calculation to provide context-rich interpretation. This means understanding what the numbers are saying about a firm's efficiency, its control over costs, and the effectiveness of its investments. This guide will equip you with the knowledge to calculate the three key profitability ratios with precision and, more importantly, to interpret them with the analytical depth required to achieve the highest marks.

Key Concepts: The Three Profitability Ratios

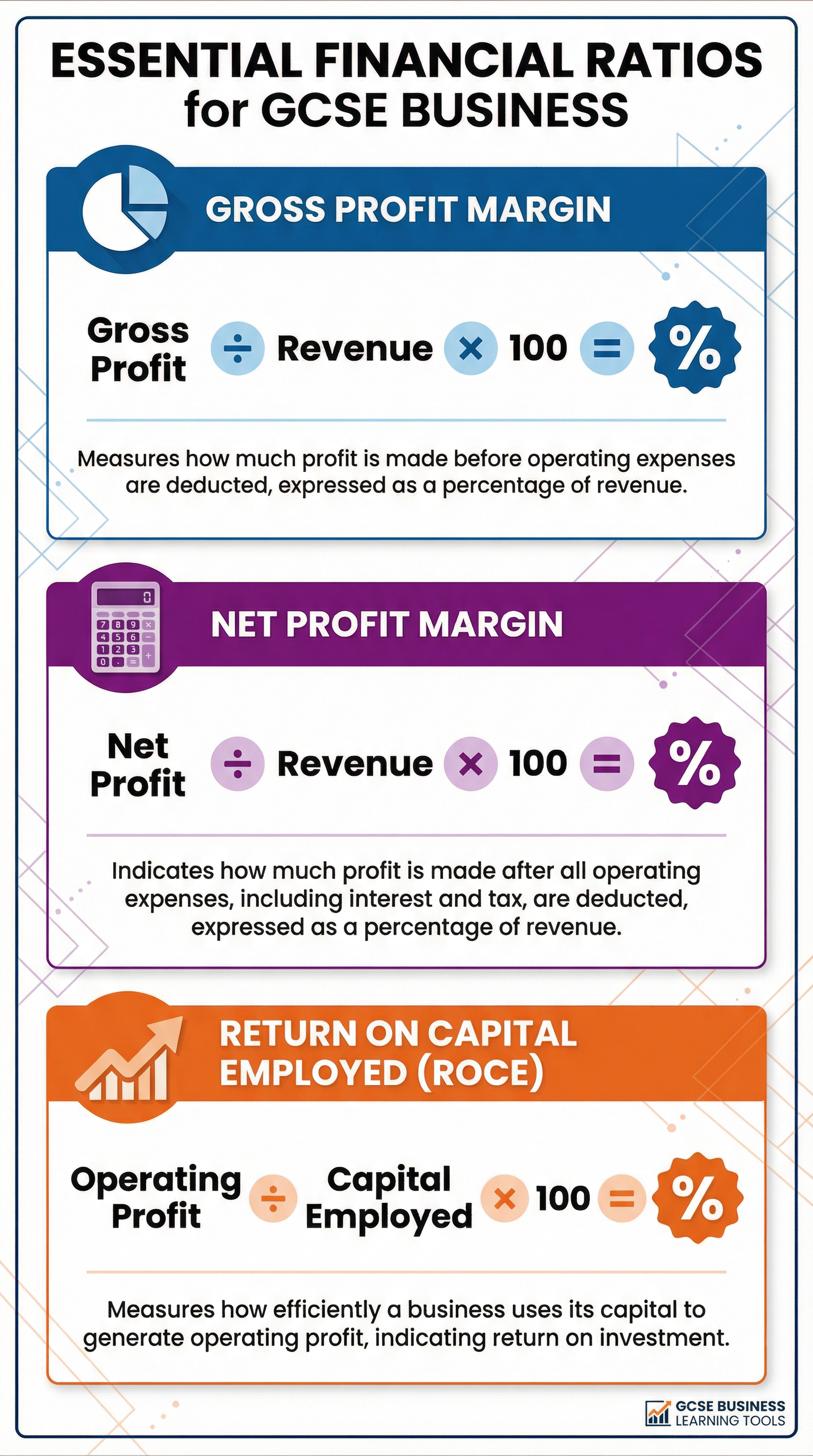

Gross Profit Margin (GPM)

What it is: This ratio measures how much profit a business makes from each sale after accounting for the direct costs of producing the goods sold (Cost of Sales). It is a primary indicator of how efficiently a business is managing its production or purchasing costs.

Why it matters: A high GPM suggests the business has strong pricing power or is effectively controlling its direct costs. A falling GPM can be an early warning sign of trouble, such as rising raw material costs or the need to discount prices.

Specific Knowledge: The formula is: (Gross Profit / Revenue) x 100. Candidates must be able to extract Gross Profit and Revenue figures from a statement of comprehensive income or a case study vignette.

Net Profit Margin (NPM)

What it is: This ratio reveals the ultimate profitability of a business after all costs and expenses, both direct and indirect (like rent, salaries, and marketing), have been deducted. It shows the percentage of revenue that is left as pure profit.

Why it matters: NPM provides a comprehensive view of a company's overall efficiency and cost management. A healthy NPM indicates that a business is not only making a profit on its products but is also running its entire operation effectively. It is often considered the 'bottom line' measure of profitability.

Specific Knowledge: The formula is: (Net Profit / Revenue) x 100. Net Profit is what remains after all expenses, including interest and tax, are subtracted from revenue.

Return on Capital Employed (ROCE)

What it is: ROCE is arguably the most powerful profitability ratio. It measures how effectively a business is using the money invested in it (Capital Employed) to generate profit. It answers the question: for every pound invested in the business, how much profit is it generating?

Why it matters: ROCE assesses the efficiency of a company's investment strategy. A high ROCE indicates that the business is generating strong returns for its investors. A key technique for analysis is to compare ROCE to the interest rates available from a bank. If ROCE is higher, the investment is worthwhile; if it's lower, investors might have been better off simply saving their money.

Specific Knowledge: The formula is: (Operating Profit / Capital Employed) x 100. Capital Employed is typically calculated as Total Assets minus Current Liabilities.

Second-Order Concepts: Interpreting the Data

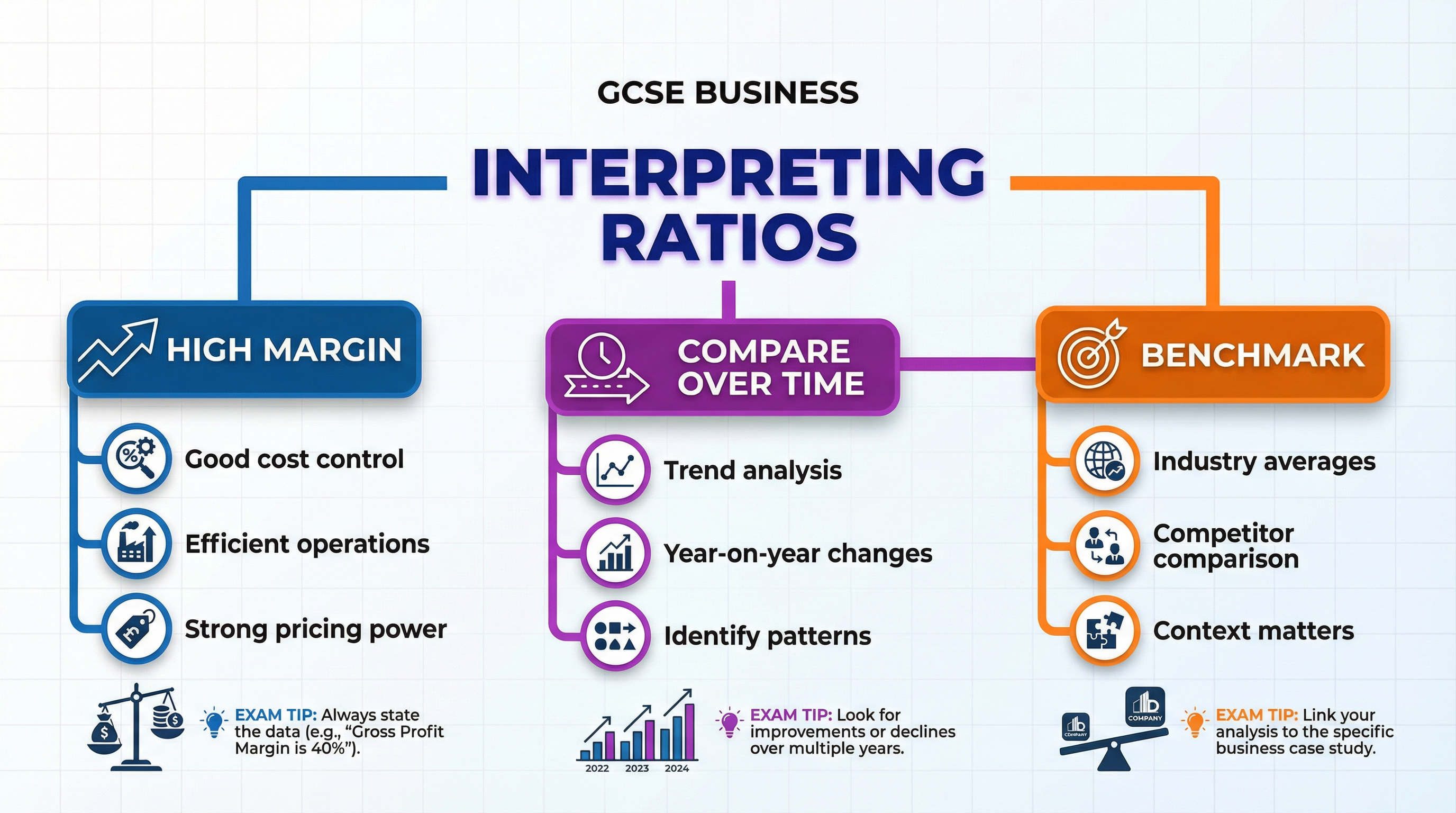

Causation

What causes ratios to change? A fall in GPM could be caused by a supplier increasing their prices. A fall in NPM, while GPM stays the same, is likely caused by a rise in operating expenses, such as a large marketing campaign or an increase in the national minimum wage.

Consequence

A declining NPM has serious consequences. It reduces the funds available for reinvestment, making it harder to grow. It can lower shareholder confidence and make it more difficult to attract further investment. A low ROCE might lead to investors withdrawing their capital.

Change & Continuity

Examiners want you to analyse ratios over time. A single ratio is a snapshot; a series of ratios over 3-5 years tells a story. Is profitability consistently improving (change) or has it remained stable (continuity)? What does this trend suggest about the business's strategy and the market it operates in?

Significance

Why does a 2% fall in Net Profit Margin matter? It might not sound like much, but for a large retailer like Tesco with billions in revenue, a 2% fall represents a huge absolute drop in profit, significantly impacting its ability to fund new stores or pay dividends to shareholders. You must explain the significance in the context of the specific business.

Source Skills: Using Data in the Exam

In the exam, financial data will be presented in tables within the case study. Your skill is to extract the correct figures and use them.

- Provenance: The data is from the business itself, so it's reliable for showing performance. However, be aware that it's historical data – it shows what has happened, not what will happen.

- Content: Use the data precisely. Quote the figures in your answer (e.g., "GPM fell from 45% in 2022 to 41% in 2023").

- Limitations: The data doesn't tell you why things have changed. That's where your business knowledge comes in. You must use the qualitative information in the case study to explain the quantitative data.