Study Notes

Overview

Cash flow forecasting is a fundamental concept in business management and a key topic in Edexcel GCSE Business (Theme 2, Section 2.4.2). It is the process of estimating the flow of cash into and out of a business over a specific period. For candidates, mastering this topic is not just about performing calculations; it is about understanding the story the numbers tell about a business's health. Examiners are looking for your ability to construct a forecast accurately, interpret its meaning for the business, and recommend appropriate actions. A strong grasp of cash flow demonstrates a sophisticated understanding of business liquidity and the challenges of day-to-day financial management. This guide will walk you through the mechanics, analysis, and strategic responses related to cash flow, ensuring you are prepared to tackle calculation and evaluation questions with confidence.

The Mechanics of a Cash Flow Forecast

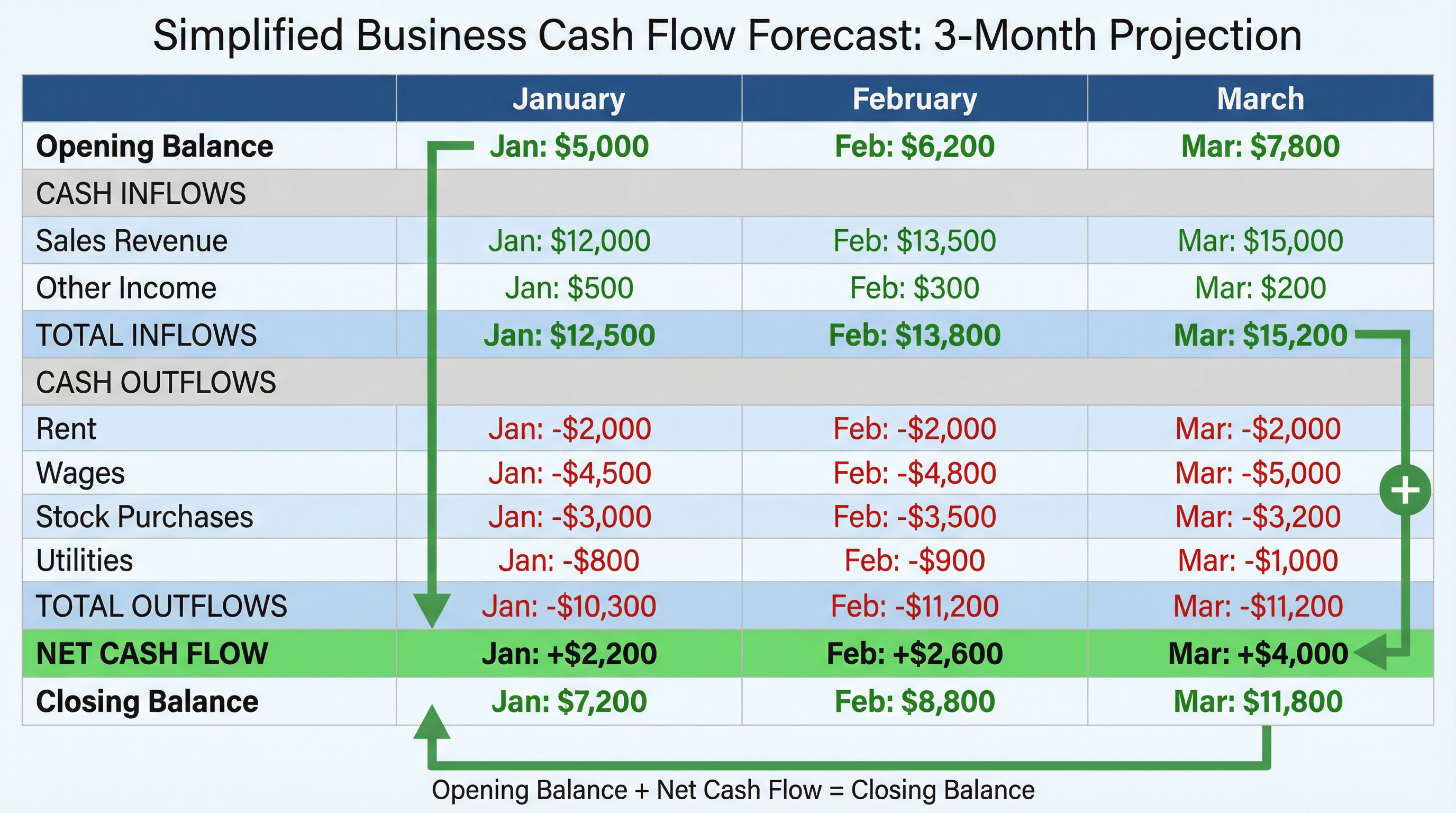

A cash flow forecast is a table that projects the movement of cash over several months. It has a clear, logical structure that you must learn to replicate. The core components are inflows, outflows, and the resulting balances.

Key Components:

- Cash Inflows: These are the sources of cash for the business. The primary inflow is typically sales revenue, but it can also include bank loans, owner's capital injections, or asset sales.

- Cash Outflows: These are the payments made by the business. Common outflows include payments for rent, wages, stock, raw materials, utilities, and marketing.

- Net Cash Flow: This is the difference between total inflows and total outflows for a given period (Net Cash Flow = Total Inflows - Total Outflows). A positive figure means more cash came in than went out, while a negative figure indicates the opposite.

- Opening Balance: This is the amount of cash the business has at the start of the period. It is the same as the previous period's closing balance.

- Closing Balance: This is the amount of cash the business has at the end of the period (Closing Balance = Opening Balance + Net Cash Flow). This figure is then carried forward to become the next month's opening balance.

Cash vs. Profit: A Crucial Distinction

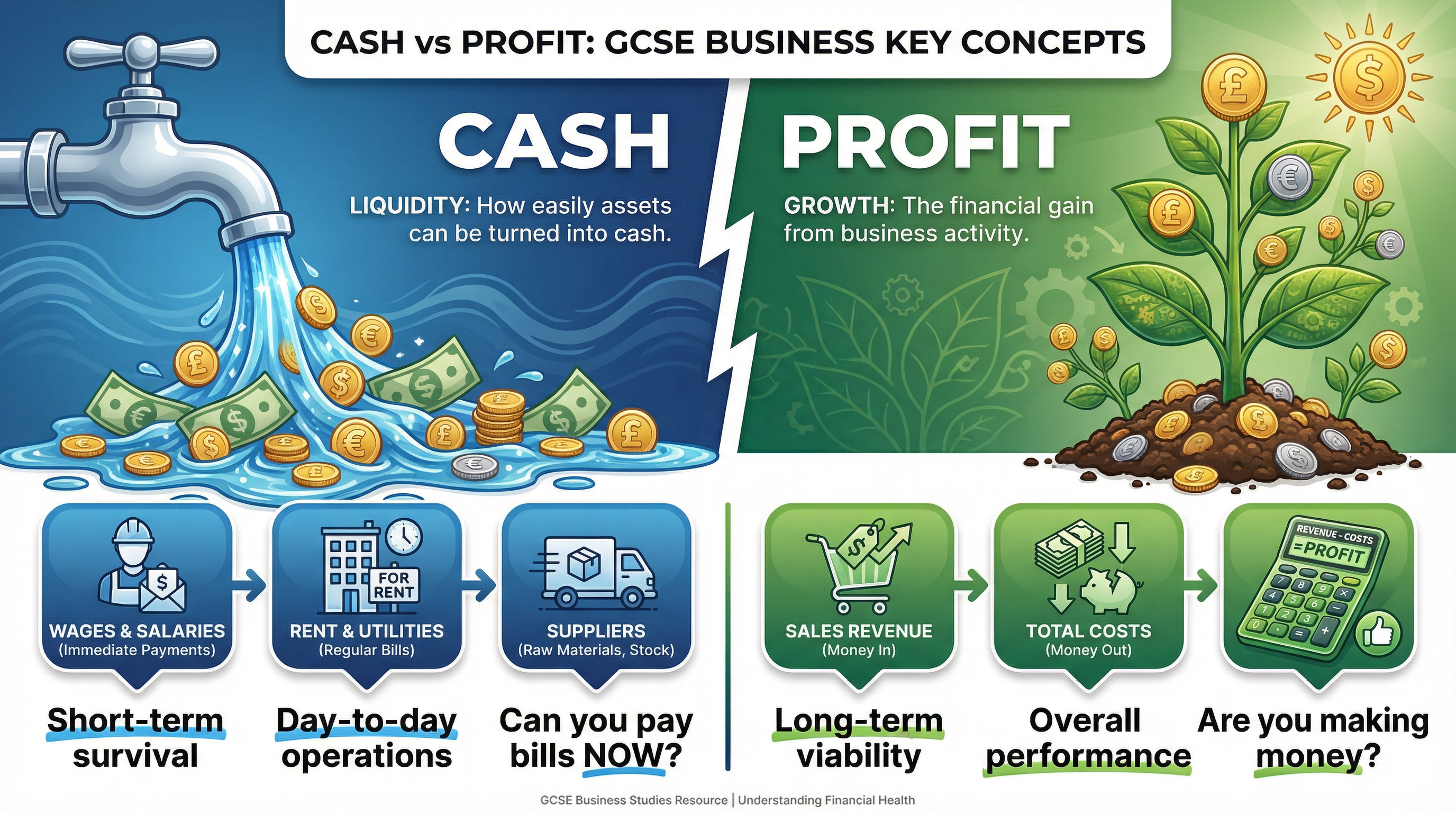

One of the most common mistakes candidates make is confusing cash with profit. They are not the same, and understanding the difference is vital for high marks.

- Cash is the money a business has available in the short term to pay its immediate bills. A business needs cash to survive day-to-day. A lack of cash leads to insolvency.

- Profit is a measure of long-term performance, calculated as Total Revenue - Total Costs over a period (usually a year). A business can be highly profitable but have no cash if its customers haven't paid their invoices yet.

Examiners frequently test this concept. Credit is given for responses that clearly distinguish between long-term profitability and short-term liquidity.

Analysing a Cash Flow Forecast

Beyond the calculations, you will be asked to analyse what the forecast means. Look for:

- Trends: Is the closing balance generally increasing or decreasing?

- Negative Net Cash Flow: Identify the months where the business spends more than it receives. What causes this? Is it a one-off (e.g., buying new equipment) or a recurring issue (e.g., low sales)?

- Liquidity Problems: A negative closing balance is a major red flag. It means the business cannot meet its financial commitments for that month. This is a liquidity crisis or insolvency.

Solving Cash Flow Problems

When a forecast predicts a cash shortfall, the business must act. You need to be able to evaluate different solutions.

Here are some common solutions:

- Bank Overdraft: A flexible, short-term solution allowing a business to spend more money than it has in its account, up to an agreed limit. It's quick to arrange but can have high interest rates.

- Short-Term Loan: Provides a lump sum of cash that is repaid over a set period with interest. Good for planned expenses but takes longer to secure than an overdraft.

- Debt Factoring: A business can sell its unpaid invoices to a factoring company for immediate cash, but it will only receive a percentage of the invoice value.

- Reduce Costs: Cutting unnecessary expenses can reduce outflows.

- Negotiate with Suppliers: Asking for longer to pay (trade credit) can delay cash outflows.

- Increase Cash Sales: Running a promotion or sale can boost immediate inflows.

When answering exam questions, you must recommend the most appropriate solution based on the business's specific situation as described in the case study.