Study Notes

Overview

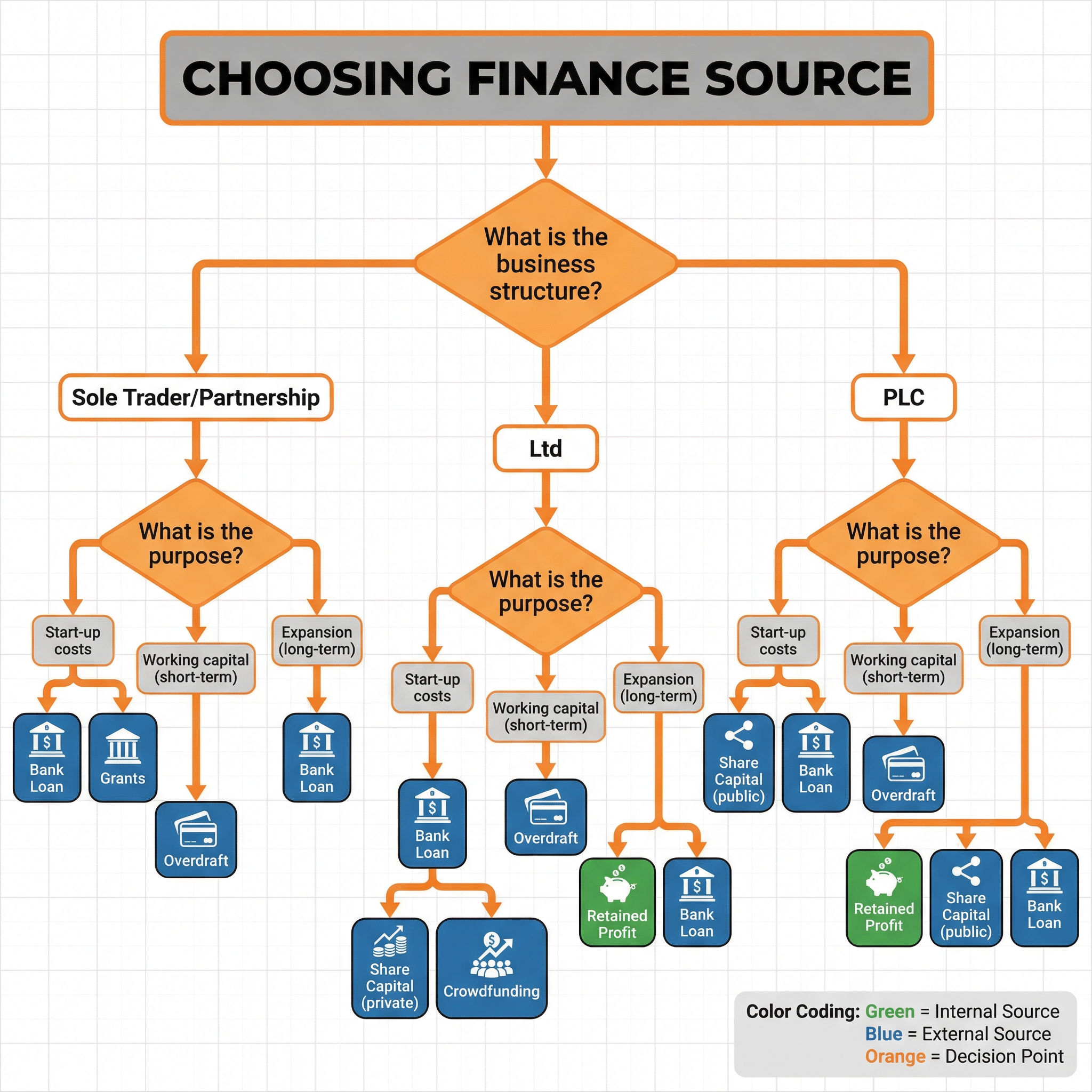

This study guide covers the essential topic of sources of finance for WJEC GCSE Business (Unit 1: Business World). Understanding how businesses raise money is fundamental to the subject and a favorite area for examiners to test. Candidates are expected to evaluate various internal and external sources of finance, considering their suitability for different business structures (Sole Traders, Partnerships, Ltds, PLCs) and purposes (start-up vs. expansion). The key to success is not just listing the sources, but analyzing their implications in terms of cost, risk, and control. This guide will equip you with the knowledge and exam technique to tackle any question on this topic with confidence.

Key Sources of Finance

Internal Sources of Finance

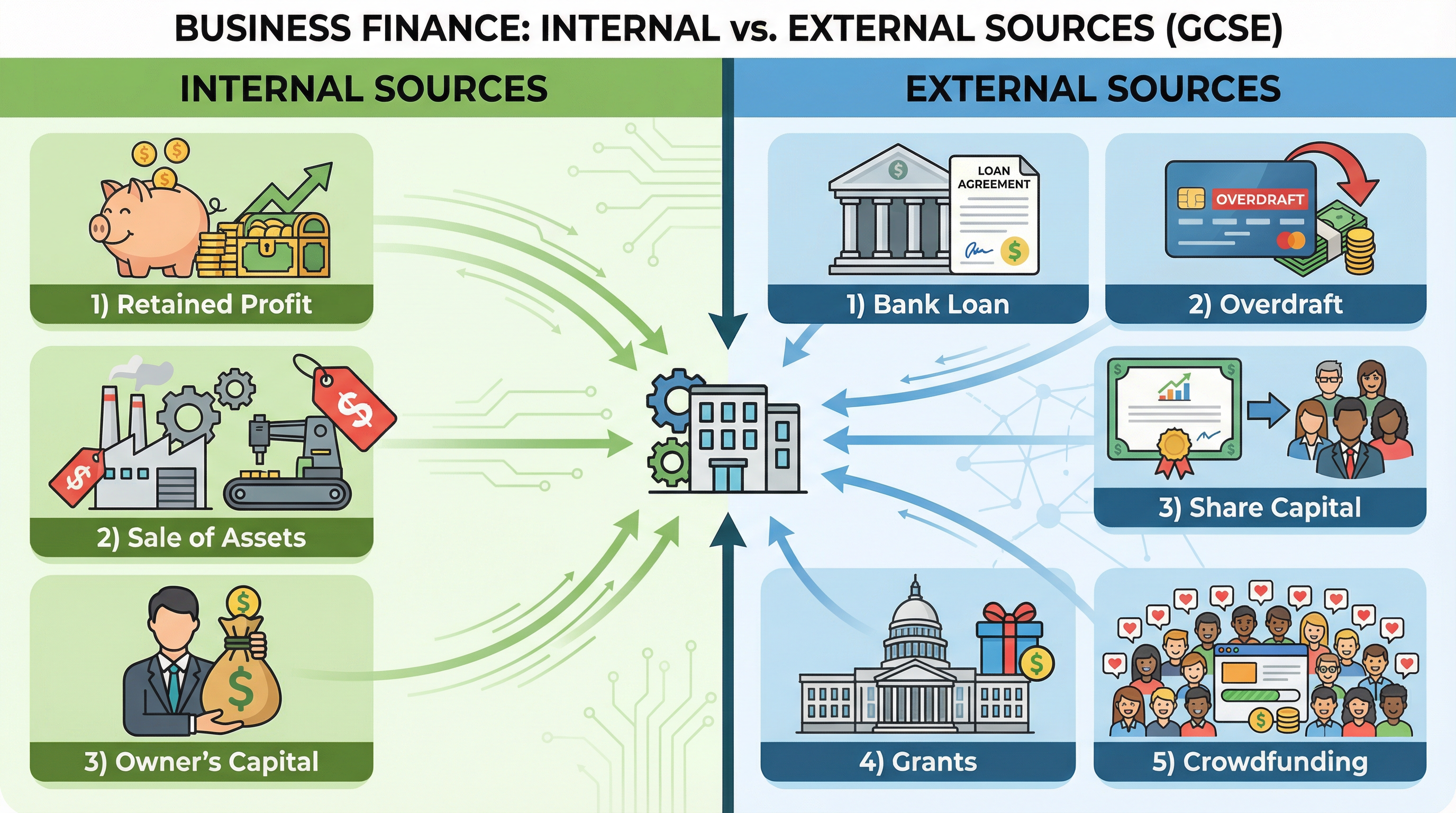

What are they?: Funds raised from within the business itself.

Why it matters: Internal finance is generally cheaper and involves less risk and no loss of control. Examiners expect you to consider these options first.

Specific Knowledge: You must know the two main types: Retained Profit (profit kept in the business from previous years) and Sale of Assets (selling owned items like machinery or vehicles).

External Sources of Finance

What are they?: Funds raised from outside the business.

Why it matters: External finance allows for larger investments and faster growth, but comes with costs (interest) and risks (loss of control or assets).

Specific Knowledge: You must be able to discuss Bank Loans (lump sum with interest), Overdrafts (flexible short-term borrowing), Share Capital (for Ltds and PLCs only), Grants (government funding), and Crowdfunding (raising small amounts from many people).

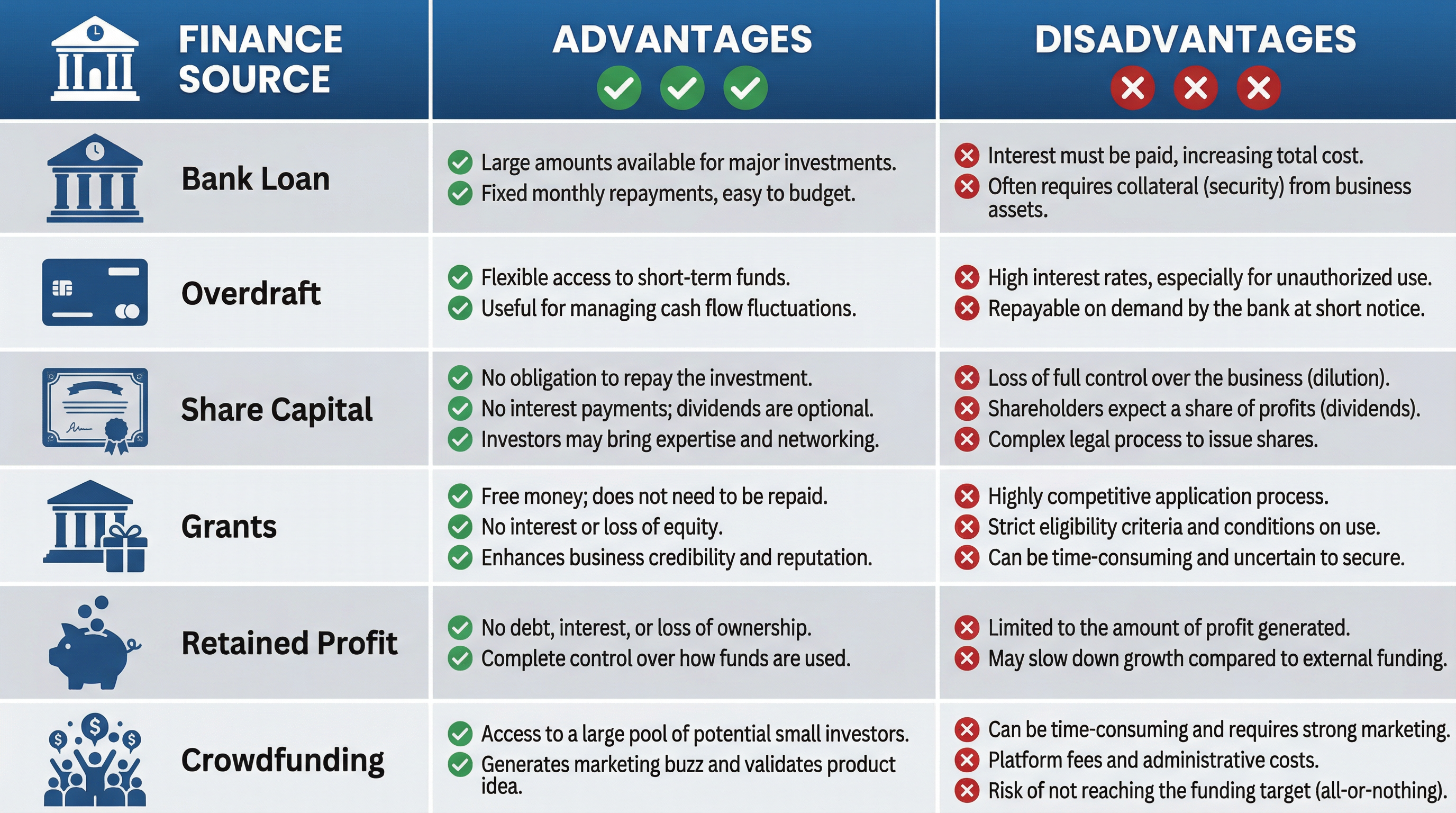

Advantages and Disadvantages

Second-Order Concepts

Appropriateness

The suitability of a finance source depends on the business structure, purpose, and circumstances. A start-up with no trading history will struggle to secure a bank loan because it cannot demonstrate the ability to repay or provide collateral. In this case, owner's capital or a government start-up grant would be more appropriate. An overdraft is appropriate for short-term cash flow issues (paying suppliers before customers pay), not for long-term capital expenditure like buying a factory. Sole traders and partnerships cannot sell shares, so equity finance is not an option for them. PLCs can raise large sums by selling shares publicly, making this appropriate for major expansion projects.

Cost

Every source of finance has a cost, either direct or indirect. Bank loans and overdrafts carry an interest cost, which increases the total amount to be repaid. The interest rate depends on the perceived risk and the Bank of England base rate. Share capital has a dividend cost - shareholders expect a share of the profits. While there's no obligation to pay dividends, failure to do so may make it difficult to attract future investors. Internal sources like retained profit appear 'free' because there's no interest or repayment, but there is an opportunity cost - the money could have been used for other purposes or distributed to owners. Grants are genuinely free in financial terms, but the application process is time-consuming and uncertain.

Risk

Different finance sources carry different risks. A bank loan carries the risk of losing collateral if repayments are missed - the bank can seize assets like property or equipment. This is particularly risky for a new business with uncertain cash flow. Selling shares carries the risk of losing control of the business through dilution of ownership. If too many shares are sold, the original owners may lose their majority stake and decision-making power. Overdrafts carry the risk of being withdrawn at short notice by the bank, leaving the business unable to pay its bills. Crowdfunding carries the risk of not reaching the funding target, resulting in no money raised and wasted time and effort.

Control

The impact on ownership and control is a critical consideration. Internal finance (retained profit, sale of assets) and debt finance (loans, overdrafts) allow the owners to retain full control of the business - they remain the sole decision-makers. Equity finance (share capital) involves giving up a share of ownership and therefore, control. New shareholders have voting rights and a say in major decisions. For a sole trader who values independence, this loss of control may be unacceptable, even if it means slower growth. For a PLC, the pressure from thousands of shareholders can force management to prioritize short-term profits over long-term strategy.

Named Example Bank

-

Dragons' Den - A TV show where entrepreneurs pitch for investment (equity finance) from wealthy investors. Demonstrates the trade-off between receiving capital and giving up ownership and control.

-

Kickstarter - A crowdfunding platform used by thousands of start-ups. For example, the Pebble smartwatch raised over $10 million from 68,000 backers in 2012, validating the product before manufacture.

-

Start Up Loans (UK Government) - A government-backed scheme providing loans of up to £25,000 to new businesses, with mentoring support. Interest rate fixed at 6% per year.

-

Barclays Bank - One of the major UK banks offering business loans and overdrafts. Requires a business plan and often collateral for loans over £25,000.

-

Tesco PLC - Raised £4 billion through a rights issue (selling new shares to existing shareholders) in 2009 to reduce debt during the financial crisis. Demonstrates how even large PLCs use share capital for major financial restructuring.

Podcast Script

[INTRO - 1 MINUTE]

Hello and welcome to GCSE Business Essentials! I'm your host, and today we're diving into one of the most crucial topics in your WJEC GCSE Business exam: sources of finance. Whether you're revising for Unit 1 or just starting this topic, this episode will give you everything you need to understand how businesses fund themselves and, more importantly, how to earn top marks in the exam.

Now, I know finance can sound a bit dry, but trust me, this is where business gets real. Every single business decision comes down to money: where to get it, how much it costs, and what you have to give up to get it. And examiners absolutely love testing you on this because it reveals whether you truly understand how different business structures work.

So grab your notes, get comfortable, and let's make sources of finance stick in your brain for good.

[CORE CONCEPTS - 5 MINUTES]

Let's start with the big picture. Sources of finance fall into two main categories: internal and external. Internal sources come from within the business itself, like retained profit or selling assets. External sources come from outside, like bank loans, share capital, or grants.

Here's the first golden rule for your exam: always check the business structure before recommending a finance source. A sole trader cannot sell shares. A partnership cannot sell shares. Only limited companies can issue shares, and only public limited companies can sell shares to the general public on the stock market. This is a fundamental error that costs candidates marks every single year.

Let's break down the main sources one by one.

First, retained profit. This is profit the business has made in previous years and kept in the business rather than paying it out to owners. It's completely internal, which means no interest, no debt, and no loss of control. The downside? It's limited to how much profit you've actually made, and it might slow down growth compared to bringing in big external funding. Examiners love this source because it's low-risk and shows financial discipline.

Next, sale of assets. This means selling things the business owns, like old machinery, vehicles, or property. It's internal, quick, and doesn't create debt. But here's the catch: you can only sell assets you actually have, and selling something essential could harm your operations. Think about it: if a bakery sells its ovens to raise cash, how will it bake bread?

Now let's move to external sources. Bank loans are probably the most common. A loan gives you a lump sum upfront, which you repay with interest over a fixed period. The advantages? Large amounts available, and fixed monthly repayments make budgeting easier. The disadvantages? Interest increases the total cost, and banks often require collateral, which is security like property or equipment. If you can't repay, the bank can seize your collateral. For start-ups with no assets, this is a major barrier.

Overdrafts are different. An overdraft is a flexible, short-term facility that lets you spend more than you have in your account, up to an agreed limit. It's brilliant for managing cash flow fluctuations, like when a supplier needs paying before your customers pay you. But overdrafts have high interest rates, especially if you go over the limit without permission, and the bank can demand repayment at any time. Use overdrafts for working capital, not long-term investment.

Share capital is where it gets interesting. Limited companies can raise money by selling shares, which represent ownership in the business. The huge advantage? No repayment obligation, no interest, and investors might bring expertise and contacts. The disadvantages? Loss of control, because shareholders now own part of your business, and they'll expect dividends, which are payments from your profit. Also, issuing shares involves legal processes and costs. Remember: private limited companies sell shares privately to friends, family, or investors. Public limited companies sell shares on the stock exchange to anyone.

Grants are essentially free money from the government or other organizations, often given to support specific activities like innovation, job creation, or environmental projects. No repayment, no interest, no loss of ownership. Sounds perfect, right? The catch is they're highly competitive, have strict eligibility criteria, and often come with conditions on how you use the money. They can also be time-consuming and uncertain to secure.

Finally, crowdfunding. This is a modern method where you raise small amounts from a large number of people, usually via online platforms. It's great for start-ups because it validates your product idea, generates marketing buzz, and gives you access to many small investors. But it's time-consuming, involves platform fees, and there's a real risk of not reaching your funding target, in which case you might get nothing.

[EXAM TIPS & COMMON MISTAKES - 2 MINUTES]

Right, let's talk exam technique, because knowing the content is only half the battle.

First, always apply context. If the question gives you a case study about a sole trader bakery wanting to expand, don't recommend selling shares. It's legally impossible. Instead, think: bank loan for long-term expansion, overdraft for short-term cash flow, or retained profit if they've been trading successfully.

Second, use the BLT structure for analysis questions. That's Because, Leading to, Therefore. For example: "A bank loan is suitable because it provides a large lump sum for capital expenditure, leading to the ability to purchase new equipment immediately, therefore enabling the business to increase production capacity and meet growing demand." See how that flows? You're not just stating facts; you're explaining the chain of consequences.

Third, always discuss trade-offs in evaluation questions. Every source of finance has advantages and disadvantages. High-level answers weigh them up and reach a justified judgment. For instance: "Although a bank loan provides immediate funds, the interest cost and collateral requirement make retained profit a better option for this established business with strong profitability."

Fourth, distinguish between short-term and long-term needs. Overdrafts are for working capital, the day-to-day money you need to operate. Loans and share capital are for capital expenditure, big investments like machinery or premises.

Common mistakes to avoid: confusing revenue with cash flow, forgetting that interest is a cost of borrowing, and failing to link your answer to the specific business in the question. Examiners reward application, not generic textbook answers.

[QUICK-FIRE RECALL QUIZ - 1 MINUTE]

Let's test your knowledge with a quick-fire quiz. Pause after each question and answer out loud.

Question one: Can a sole trader sell shares to raise finance? No, only limited companies can issue shares.

Question two: What's the main advantage of retained profit? No interest, no debt, and complete control retained.

Question three: What's the difference between a loan and an overdraft? A loan is a lump sum repaid over a fixed period; an overdraft is flexible short-term borrowing up to a limit.

Question four: Why might a business choose a grant over a bank loan? Grants don't need to be repaid and have no interest, though they're competitive and have strict conditions.

Question five: What does collateral mean? Security, like property or equipment, that a bank can seize if you don't repay a loan.

How did you do? If you got them all, brilliant. If not, go back and listen again to the sections you're unsure about.

[SUMMARY & SIGN-OFF - 1 MINUTE]

Let's wrap up. Today we've covered the essential sources of finance for GCSE Business: internal sources like retained profit and sale of assets, and external sources like loans, overdrafts, share capital, grants, and crowdfunding. We've explored the advantages and disadvantages of each, and we've discussed how to apply this knowledge in exam conditions.

Remember the key exam strategies: always check the business structure, use the BLT framework for analysis, discuss trade-offs in evaluation questions, and apply your knowledge to the specific context in the question. Examiners are looking for candidates who can think like business owners, weighing up costs, risks, and control.

Before your exam, make sure you can define each source, explain when it's appropriate, and evaluate which is best for a given scenario. Practice past papers, especially the longer evaluation questions, and always justify your recommendations with clear reasoning.

That's it for today's episode of GCSE Business Essentials. If you found this helpful, make sure to revisit your notes, test yourself with practice questions, and keep building that exam confidence. Good luck with your revision, and remember: understanding sources of finance isn't just about passing an exam. It's about understanding how the business world actually works.

Thanks for listening, and I'll see you next time.