Study Notes

Overview

Choosing the right source of finance is one of the most critical decisions a business will make. It dictates the speed of growth, the level of risk, and the control an owner retains. For WJEC GCSE Business candidates, this topic is a cornerstone of Unit 2, requiring not just knowledge of different financial sources, but the ability to critically apply this knowledge to specific business scenarios. Examiners are looking for candidates who can move beyond simple definitions and analyse the complex interplay between a business’s legal structure (e.g., Sole Trader vs. PLC), the amount of capital required, and the purpose of the finance. This guide will break down these factors, providing you with the framework and specific knowledge to construct high-level analytical arguments that are consistently rewarded with top marks.

Key Concepts: Internal vs. External, Short-Term vs. Long-Term

Internal Finance

What it is: Money sourced from within the business itself. It is the cheapest and lowest-risk form of capital.

Why it matters: Examiners expect you to recognise that internal finance involves no loss of control and incurs no interest costs. It is the first port of call for most businesses.

Specific Knowledge: The two primary sources of internal finance are:

- Owner's Capital / Personal Savings: The money invested by the owner(s) to start or support the business. This is most common in new or small businesses.

- Retained Profit: Profit from previous trading periods that is ploughed back into the business rather than being taken out by the owners. This is a key source for established, profitable businesses seeking to fund growth.

External Finance

What it is: Money sourced from individuals or institutions outside the business.

Why it matters: External finance is essential for significant growth, such as major expansion or investment in new technology, but it always comes with a cost—either interest payments or a loss of ownership.

Specific Knowledge: External sources can be categorised by the length of time the finance is needed for.

Short-Term Finance (Typically up to 3 years)

- Bank Overdraft: An agreement with a bank to withdraw more money than is in the account, up to a pre-agreed limit. It is highly flexible and ideal for managing day-to-day cash flow problems, but interest is charged daily on the overdrawn amount and can be expensive.

- Trade Credit: The practice of buying raw materials or stock from a supplier and paying for them at a later date (e.g., 30-90 days). It is a crucial source of working capital but can damage relationships with suppliers if not managed carefully.

Long-Term Finance (Typically 3+ years)

- Bank Loan: Borrowing a fixed sum of money from a bank, which is repaid in regular instalments over a set period. The interest rate can be fixed or variable. It is suitable for major capital expenditure, like buying property or machinery.

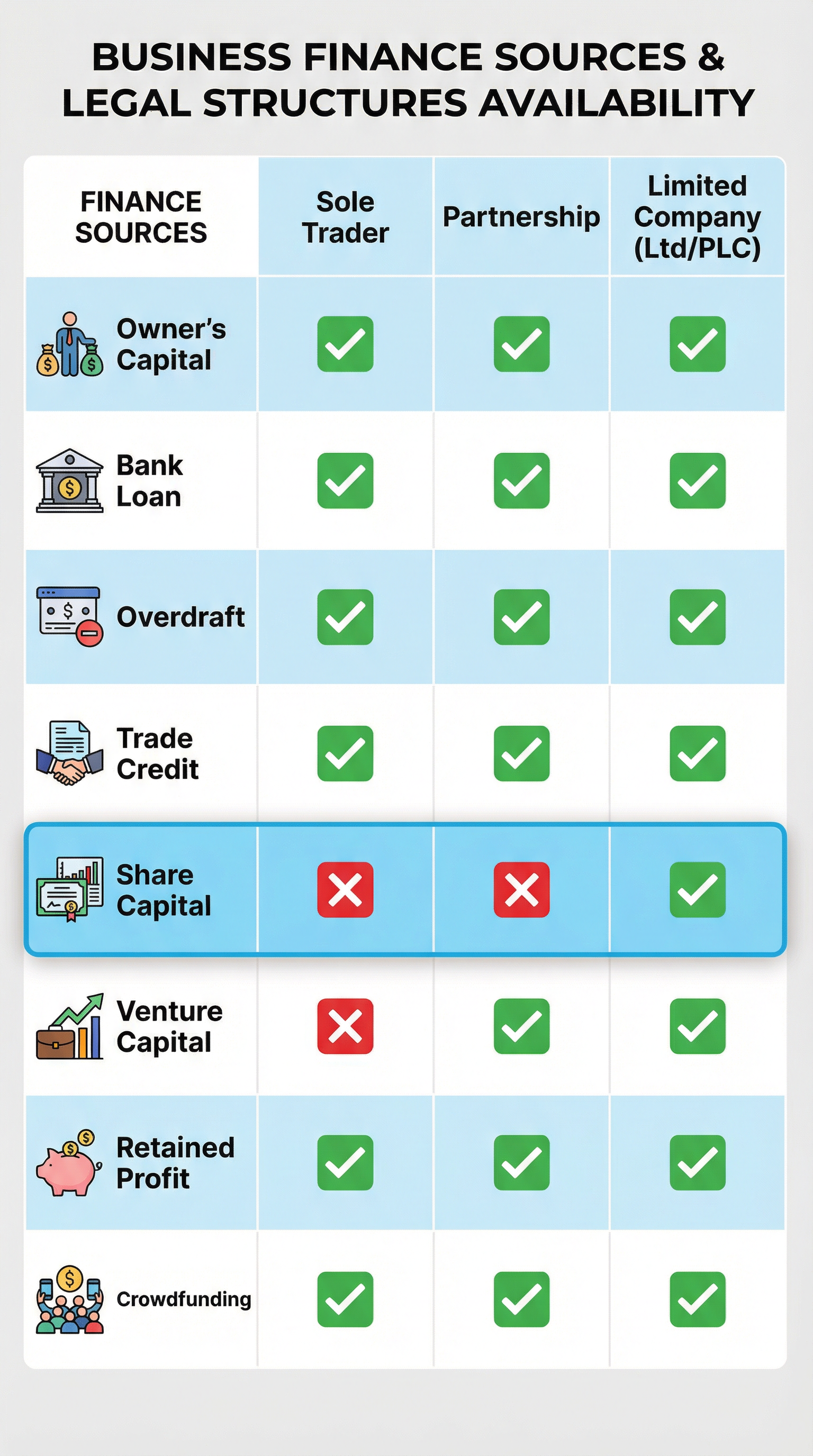

- Share Capital: (Limited Companies Only) Money raised by selling shares of ownership in the business. This is a vital source for Ltds and PLCs looking to raise substantial funds. While there are no interest repayments, it dilutes the control of existing owners.

- Venture Capital: Investment from a specialist firm in exchange for a significant equity stake in the business. Venture capitalists often seek high-growth potential businesses and provide expertise, but they demand a large share of control and profits.

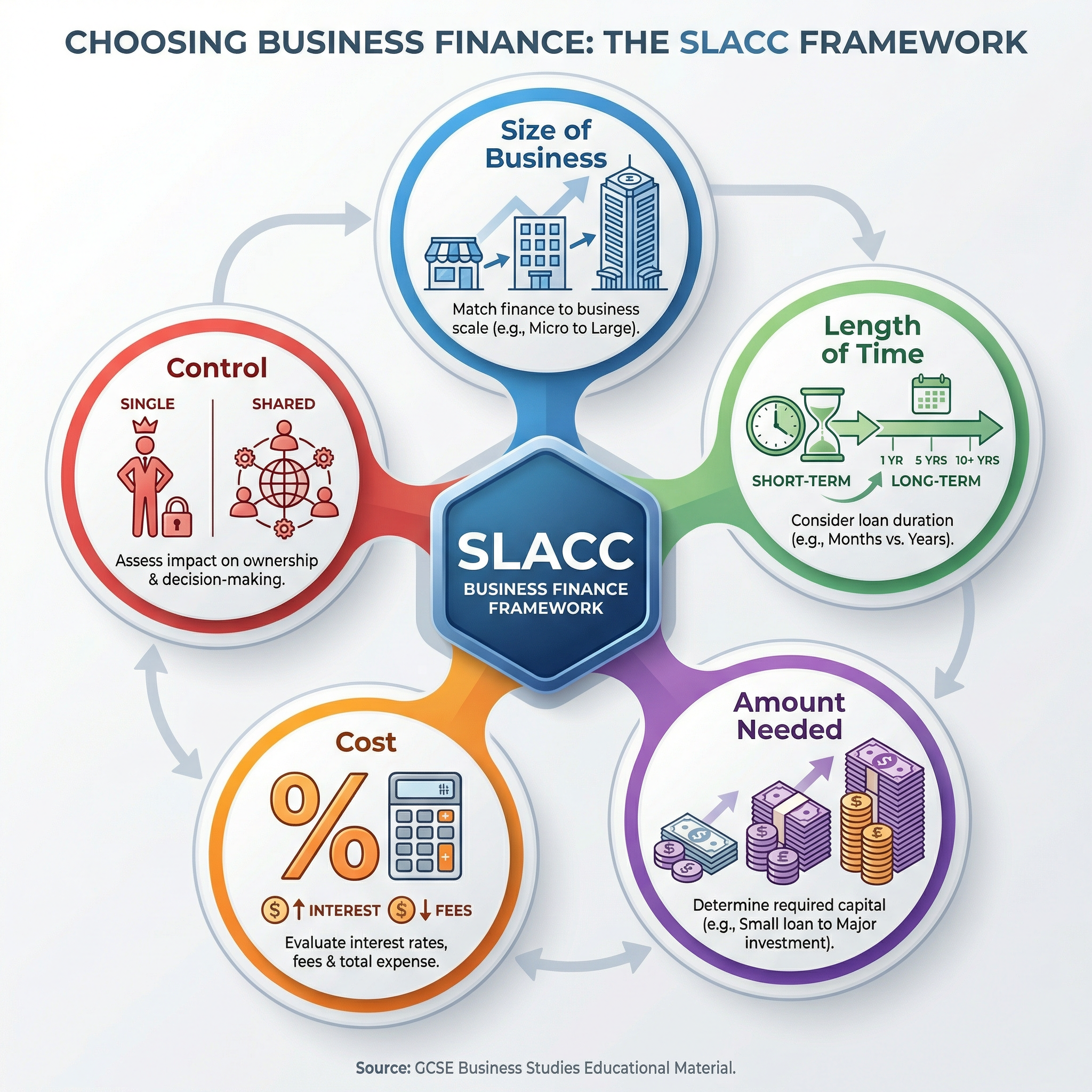

The SLACC Framework: Your Key to Evaluation

To analyse which source of finance is best, you must use a framework. The SLACC mnemonic is the perfect tool for this, ensuring you cover all the key analytical points.

- S - Size & Structure: The legal structure of the business is the most important factor. A sole trader cannot issue shares, whereas a PLC can raise millions through a stock market flotation. Examiners award significant marks for recognising this distinction.

- L - Length of Time: The purpose of the finance dictates the required term. A short-term cash flow issue requires a short-term solution like an overdraft, not a long-term loan.

- A - Amount: The sum required will rule out certain sources. A £5,000 loan for a new computer system is a simple bank loan, whereas a £50 million factory requires a more complex combination of finance, likely including share capital.

- C - Cost: Candidates must assess the financial cost. This includes interest rates on loans, but also the implicit cost of losing ownership and future profits when issuing shares.

- C - Control: How much control are the owners willing to give up? A sole trader who values their autonomy will avoid external investors, whereas the directors of a PLC are accountable to thousands of shareholders.

Source Skills for Business

In the exam, you will be given a case study or data response scenario. Your task is to act as a business consultant. Use the data provided—such as profit figures, the legal structure, and the reason finance is needed—to justify your recommendation. Always use the language of the case study in your answer. For example, instead of saying "a business might need a loan," say "Javed's plumbing business needs a £15,000 loan to purchase a new van."