Study Notes

Overview

Economic growth is a central concept in macroeconomics and a recurring topic in the OCR J205 Component 02 exam. It refers to the increase in the production of goods and services in an economy over a specific period. For examiners, a candidate's ability to precisely define and measure growth, analyse its causes and consequences, and evaluate its overall impact is critical. This guide will cover the essential definitions, such as Gross Domestic Product (GDP) and GDP per capita, the distinction between real and nominal values, and the analytical frameworks of Aggregate Demand (AD) and Aggregate Supply (AS). By mastering this topic, candidates can build a strong foundation for understanding related concepts like inflation, unemployment, and government policy, thereby enhancing their ability to construct well-supported arguments in the exam.

Measuring Economic Growth

Gross Domestic Product (GDP)

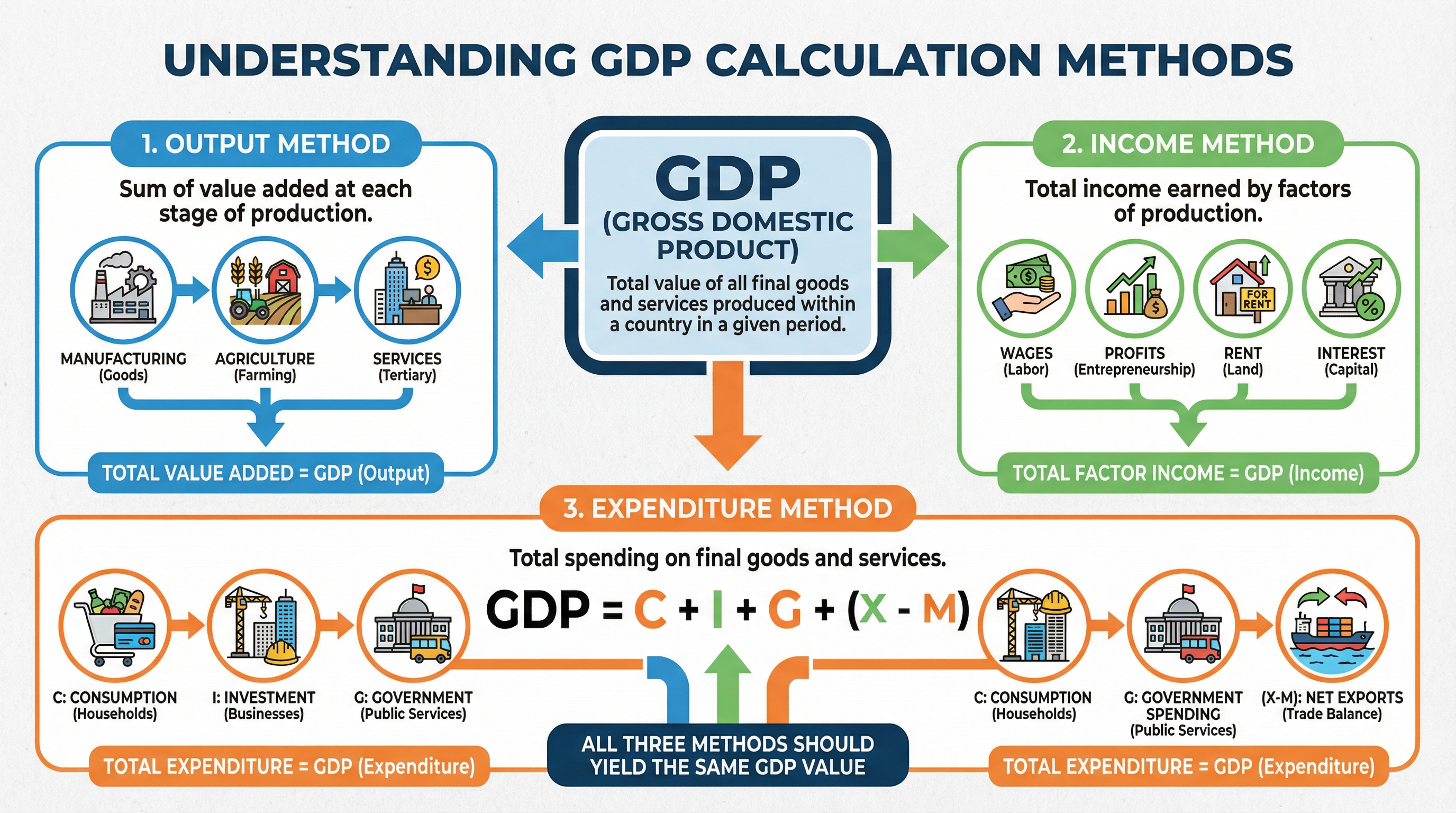

What it is: GDP is the total monetary value of all final goods and services produced within a country's borders in a specific time period, typically a year or a quarter. It is the most common measure of a country's economic output.

Why it matters: Examiners expect candidates to know that GDP is a key indicator of economic health. An increase in GDP signifies economic growth, while a decrease indicates economic contraction (recession).

Specific Knowledge: Candidates must be able to distinguish between Nominal GDP, which is measured at current market prices, and Real GDP, which is adjusted for inflation. Real GDP provides a more accurate picture of an economy's growth. For example, if Nominal GDP grows by 5% but inflation is 3%, Real GDP has only grown by 2%.

GDP per Capita

What it is: GDP per capita is the total GDP of a country divided by its population. It represents the average economic output per person.

Why it matters: This is a crucial measure for assessing a country's standard of living. While a country's total GDP might be high, a large population could mean that the average income and living standards are relatively low. Examiners award credit for candidates who use GDP per capita to make nuanced arguments about living standards.

Causes of Economic Growth

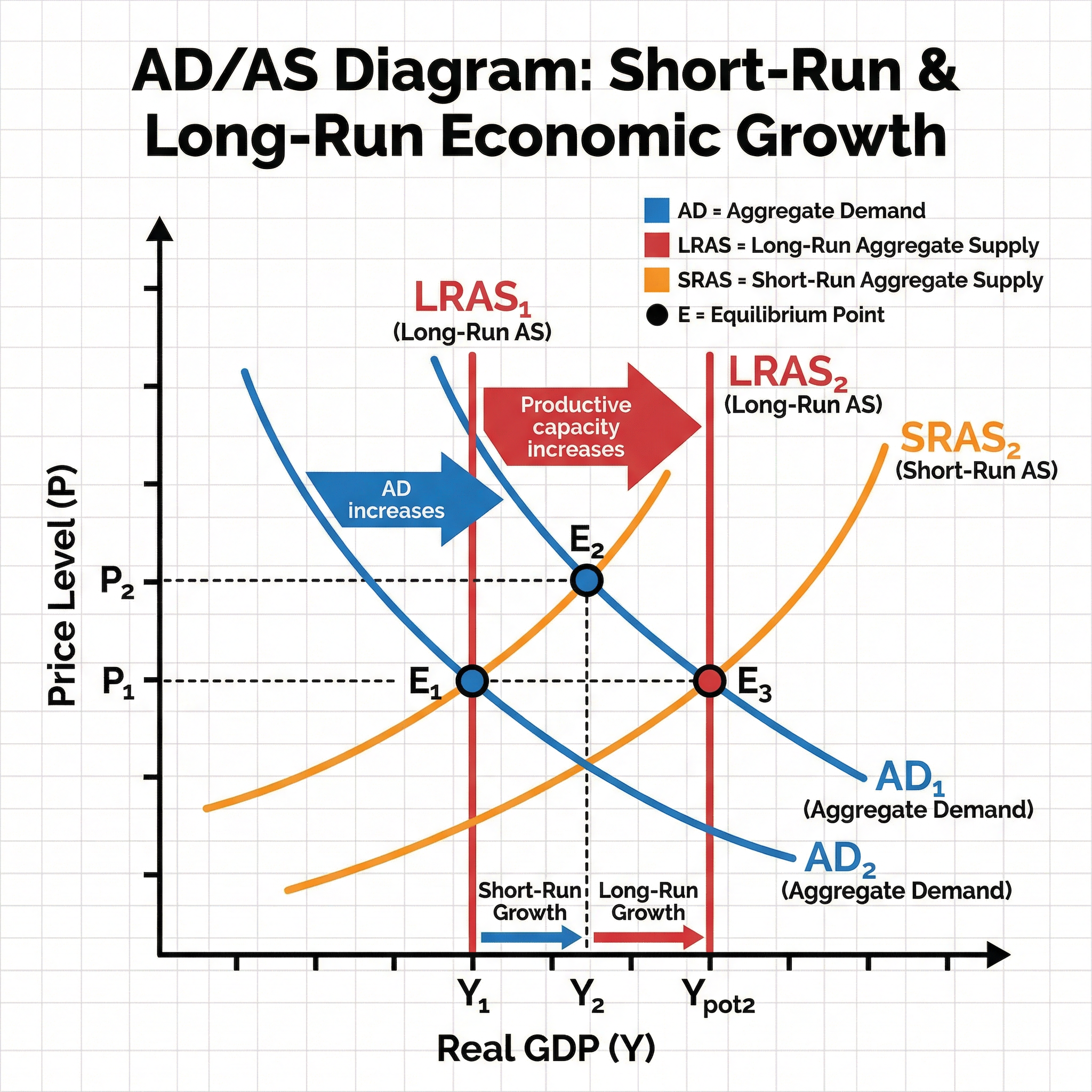

Economic growth can be driven by factors affecting either aggregate demand (short-run growth) or aggregate supply (long-run growth).

Short-Run Growth (Increase in Aggregate Demand)

What it is: This occurs when there is an increase in any of the components of Aggregate Demand (AD = C + I + G + (X-M)). This type of growth uses up spare capacity in the economy.

Causes:

- Increased Consumption (C): Lower interest rates, higher consumer confidence, or tax cuts can lead to more household spending.

- Increased Investment (I): Lower interest rates or positive business expectations can encourage firms to invest in new capital.

- Increased Government Spending (G): The government might increase spending on infrastructure, healthcare, or education.

- Increased Net Exports (X-M): A weaker exchange rate or strong growth in other countries can boost export demand.

Long-Run Growth (Increase in Aggregate Supply)

What it is: This involves an increase in the economy's productive potential, represented by an outward shift of the Long-Run Aggregate Supply (LRAS) curve.

Causes:

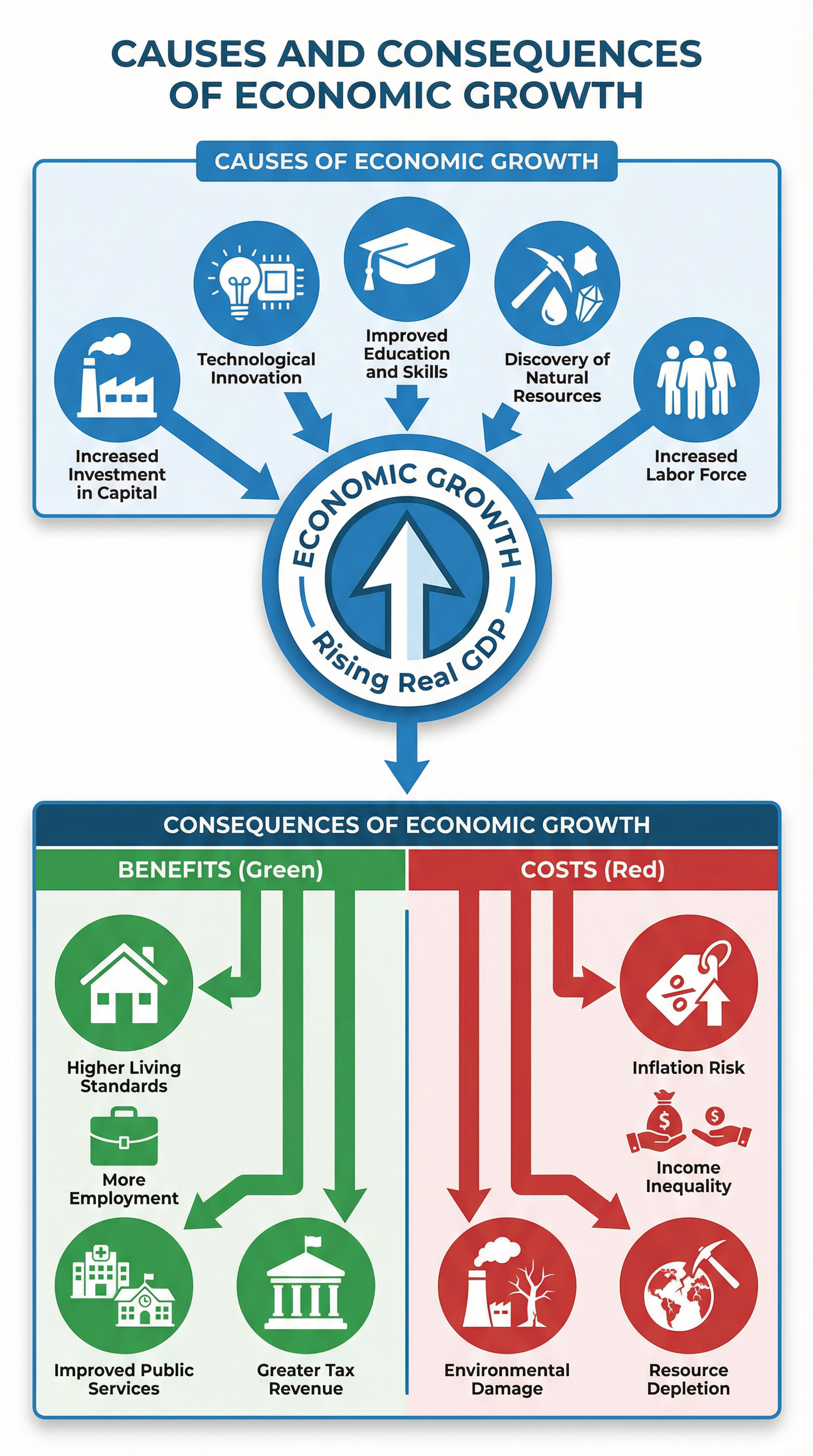

- Increase in the Quantity of Factors of Production: More labour (e.g., through immigration), more capital (through investment), or the discovery of new natural resources.

- Increase in the Quality of Factors of Production: A better-educated and skilled workforce, or technological advancements that improve productivity.

Consequences of Economic Growth

Candidates must be able to evaluate both the benefits and costs of economic growth.

Benefits

- Higher Living Standards: Increased real GDP per capita allows people to afford more goods and services, improving their quality of life.

- Increased Employment: As firms produce more, they typically need to hire more workers, reducing unemployment.

- Fiscal Dividend: Higher incomes and profits lead to greater tax revenues for the government, which can be used to fund public services or reduce national debt.

Costs

- Inflationary Pressure: If AD grows faster than AS, it can lead to demand-pull inflation.

- Income and Wealth Inequality: The benefits of growth may not be distributed evenly, potentially widening the gap between the rich and the poor.

- Environmental Costs: Increased production can lead to negative externalities such as pollution, resource depletion, and climate change.