Study Notes

Overview

Monetary policy is a fundamental tool for managing a modern economy, and for the OCR J205 specification, candidates must have a firm grasp of its mechanisms and effects. This guide covers the actions of the Bank of England's Monetary Policy Committee (MPC) as they aim to meet the government's 2.0% CPI inflation target. We will dissect the transmission mechanism of interest rates, exploring the direct impact on borrowing, saving, consumption, and investment. Furthermore, we will demystify the more complex tool of Quantitative Easing (QE), used during periods of economic stagnation. Examiners expect candidates to not only define these concepts but also to analyse their impact on Aggregate Demand (AD) and evaluate their effectiveness, considering real-world complexities like time lags and consumer confidence. This topic is not just theoretical; it shapes the interest rates on savings accounts, the cost of mortgages, and the health of the job market, making it a vital area of study.

Key Concepts & Mechanisms

The Monetary Policy Committee (MPC)

Role: The MPC is a committee within the Bank of England responsible for setting the main monetary policy instrument, the Bank Rate. It consists of nine members, including the Governor of the Bank of England. Their primary objective is to maintain price stability, defined by the government's 2.0% inflation target.

Key Actions: The MPC meets regularly to decide on the appropriate level for the Bank Rate. Their decisions are based on a wide range of economic data, from GDP growth and unemployment figures to consumer confidence surveys. They vote to raise, lower, or maintain the rate.

Impact: The MPC's decisions have a ripple effect across the entire UK economy. Their independence from the government is a key feature, designed to ensure that decisions are made for long-term economic stability rather than short-term political gain. Candidates must be clear that the MPC, not the government, sets the interest rate.

The Interest Rate Transmission Mechanism

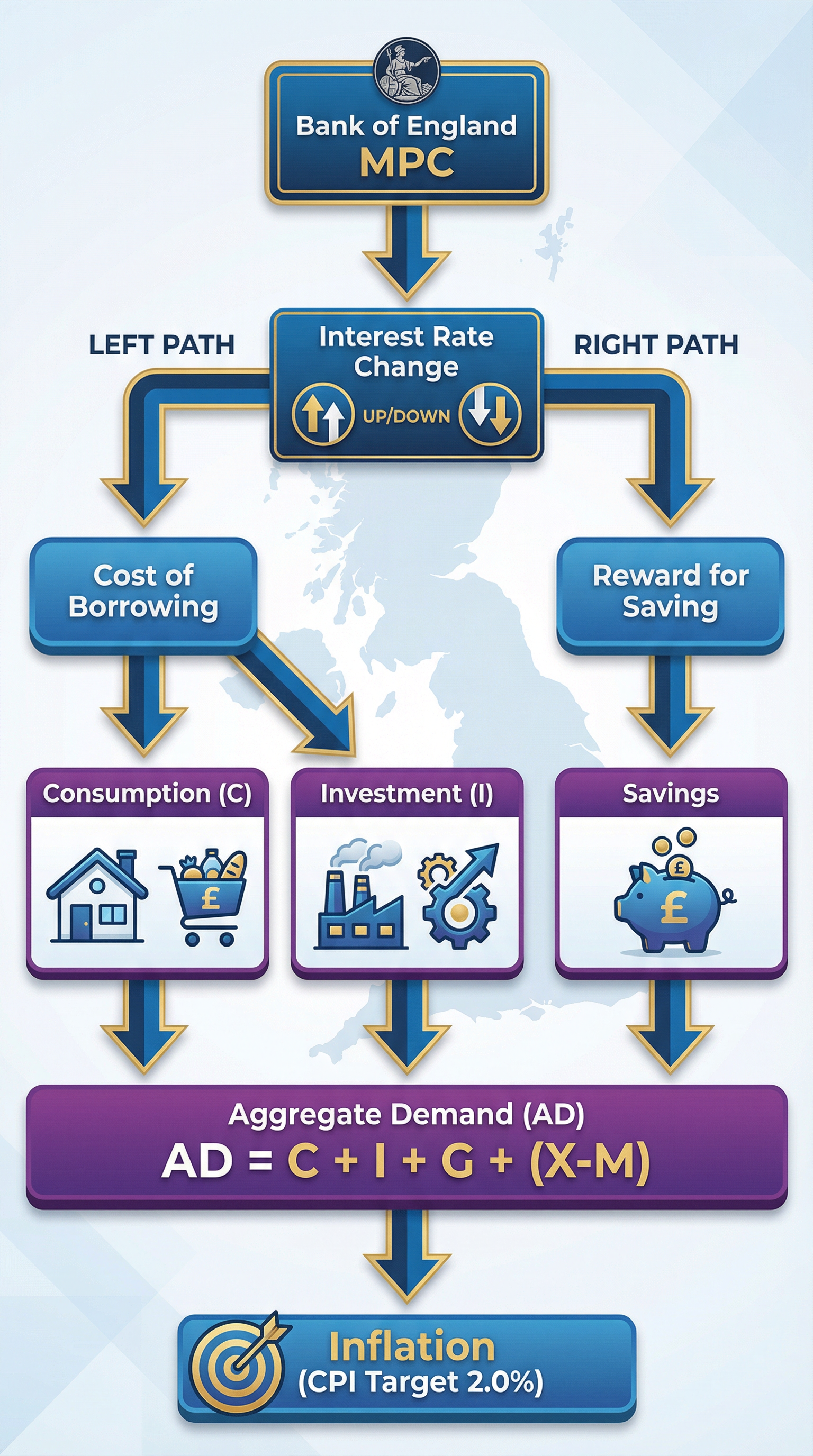

What it is: This is the process through which a change in the Bank Rate affects the wider economy, particularly Aggregate Demand and inflation. Understanding this chain of events is crucial for earning analysis marks.

How it works: A change in the Bank Rate affects the rates commercial banks offer to their customers.

- Higher Interest Rates: When the MPC raises the Bank Rate, borrowing becomes more expensive (discouraging Consumption and Investment) and saving becomes more rewarding (further reducing spending). This leads to a fall in Aggregate Demand, which helps to reduce inflationary pressure.

- Lower Interest Rates: When the MPC lowers the Bank Rate, borrowing becomes cheaper (stimulating Consumption and Investment) and saving becomes less attractive. This leads to a rise in Aggregate Demand, which helps to boost economic growth and employment.

Quantitative Easing (QE)

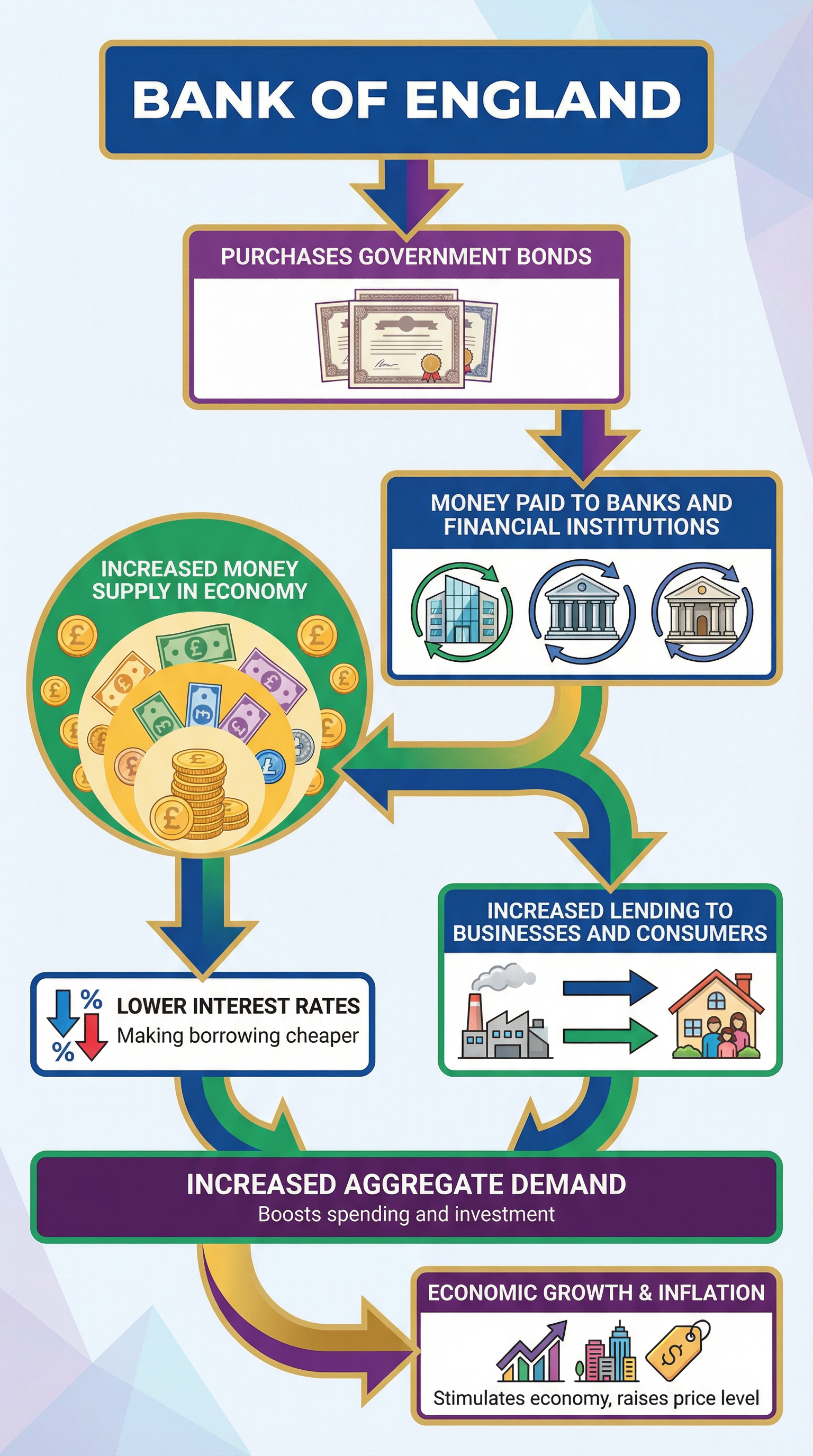

What it is: QE is an unconventional monetary policy tool used when interest rates are already close to zero and cannot be cut further. It is sometimes referred to as 'printing money', but this is a simplification. The Bank of England creates new money digitally, which it then uses to buy assets (mainly government bonds) from financial institutions.

Why it matters: The aim of QE is to increase the money supply in the economy. When the Bank of England buys bonds, it increases the liquidity of commercial banks. This encourages them to lend more to households and businesses, boosting Consumption (C) and Investment (I). It also pushes down longer-term interest rates. The overall goal is to stimulate Aggregate Demand during periods of economic stagnation.

Second-Order Concepts

Causation

- Cause of Policy Change: The primary trigger for a change in monetary policy is the forecast for inflation. If the CPI inflation forecast is significantly above the 2.0% target, the MPC is likely to raise rates. If it is significantly below, and the economy is weak, they are likely to lower rates or use QE.

- Chain of Causation: For analysis, you must show the causal links: MPC changes Bank Rate → commercial bank rates change → cost of borrowing and reward for saving change → incentives for households (C) and firms (I) change → Aggregate Demand shifts → inflation and economic growth are affected.

Consequence

- Intended Consequences: The intended consequences are stable inflation around the 2.0% target and stable economic growth.

- Unintended Consequences: Higher interest rates can lead to a stronger exchange rate (as foreigners buy pounds to save in UK banks), which can harm exporters. QE can increase asset prices, like houses and stocks, which may increase wealth inequality.

Significance

Monetary policy is significant because it is the UK's primary tool for managing the economic cycle. Its effectiveness, however, is a major point of debate for evaluation. Its significance is limited by factors like the scale of the rate change, the level of consumer confidence, and the significant time lags involved before the full effects are felt.