Study Notes

Overview

Welcome to your essential guide to Exchange Rates for OCR GCSE Economics (J205). This topic is a cornerstone of Component 02: The UK and Global Economy, and understanding it is crucial for explaining how the UK interacts with the rest of the world. An exchange rate is the price of one currency in terms of another, but its impact goes far beyond holiday spending money. Fluctuations in exchange rates affect the price of everything we import and export, influencing inflation, employment, and the country's overall balance of payments. Examiners expect candidates to be fluent in the language of appreciation and depreciation, to analyse the causes of these changes using supply and demand diagrams, and to evaluate the consequences for households, businesses, and the government. This guide will equip you with the precise knowledge, analytical skills, and exam techniques needed to tackle any question on this topic with confidence.

How Exchange Rates are Determined

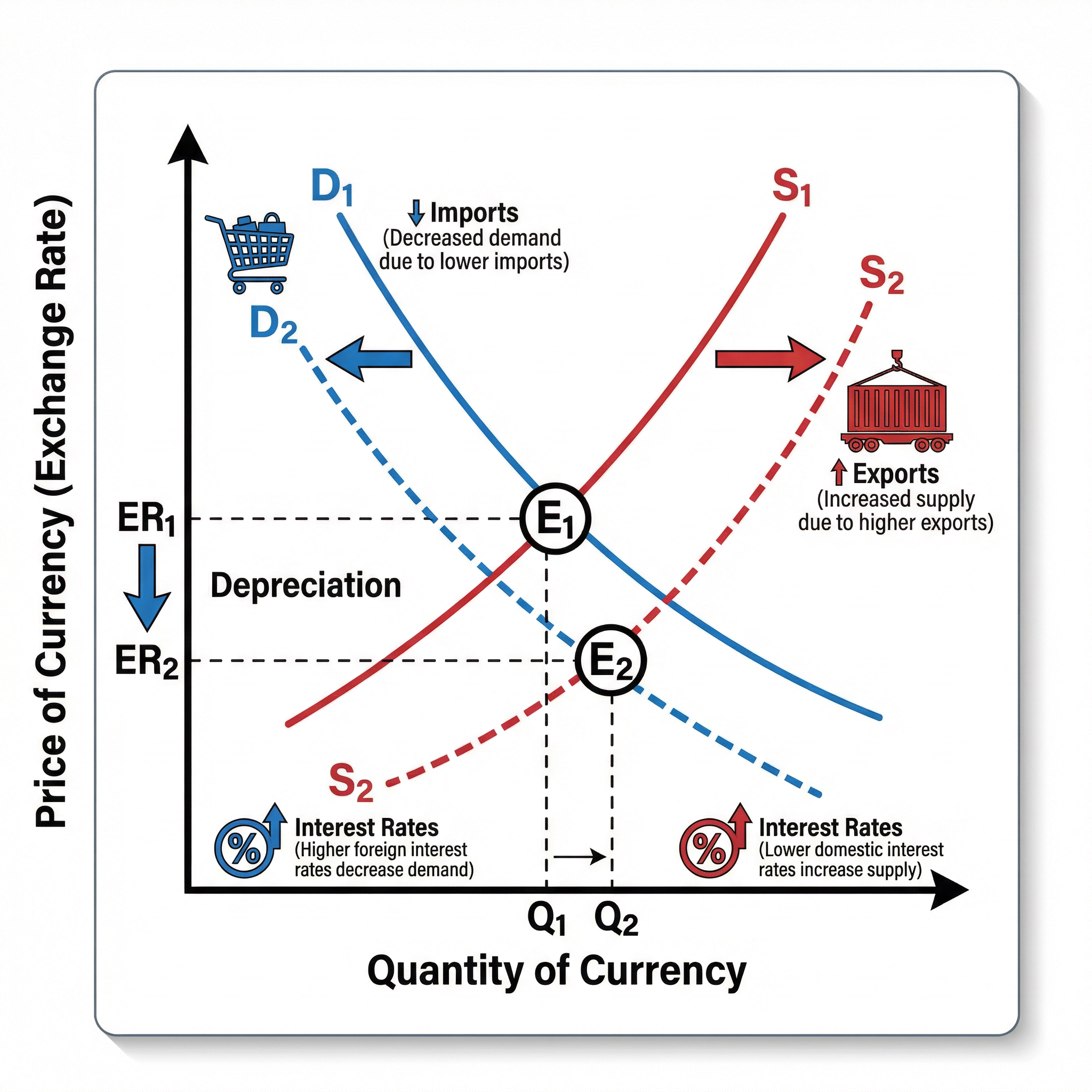

The value of a currency, like the British Pound (£), is determined on the foreign exchange market (Forex) through the forces of supply and demand.

- Demand for the Pound: Created by foreign individuals, firms, or governments who need pounds to buy UK goods and services (exports), to invest in UK assets (e.g., property, shares), or to save in UK banks. When demand for pounds rises, the currency appreciates (gets stronger).

- Supply of the Pound: Created by UK individuals, firms, or the government who need to sell pounds to acquire foreign currency. This is done to buy foreign goods and services (imports), to invest abroad, or to holiday in other countries. When the supply of pounds rises, the currency depreciates (gets weaker).

The equilibrium exchange rate is found where the demand for the currency equals its supply. Any factor that shifts either the supply or demand curve will lead to a new exchange rate.

Key Factors Influencing Exchange Rates

-

Changes in Demand for Exports and Imports: If UK exports become more desirable (e.g., due to higher quality or better marketing), demand for the pound will rise, causing appreciation. Conversely, if UK consumers increase their spending on imported goods, they will supply more pounds to the market, causing depreciation.

-

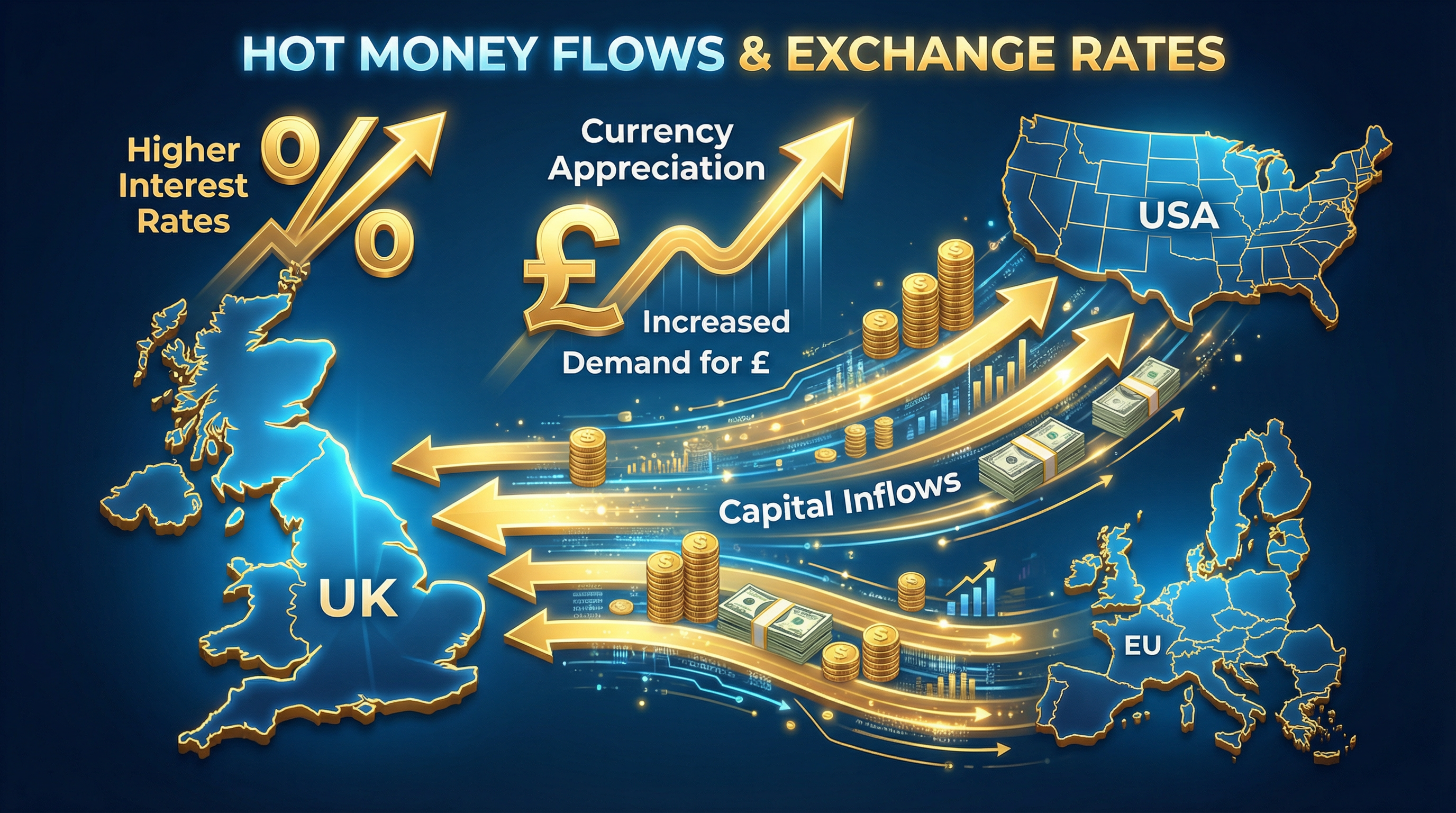

Changes in Interest Rates ('Hot Money'): This is a critical point for achieving high marks. If the Bank of England raises UK interest rates relative to other countries, it becomes more attractive for foreign investors to save their money in UK banks to get a better return. These short-term, speculative capital flows are known as 'hot money'. To save in the UK, these investors must first buy pounds, increasing demand and causing the pound to appreciate. This is a powerful and fast-acting mechanism.

-

Foreign Direct Investment (FDI): When a foreign company decides to build a factory or open offices in the UK (e.g., Nissan in Sunderland), it must buy pounds to pay for construction, materials, and workers. This large-scale investment increases the demand for the pound and leads to appreciation.

-

Speculation: Forex traders buy and sell currencies to make a profit. If speculators believe the pound will be stronger in the future, they will buy it now. This act of buying the currency increases its demand and can become a self-fulfilling prophecy, causing the appreciation they predicted.

The Impact of Exchange Rate Fluctuations

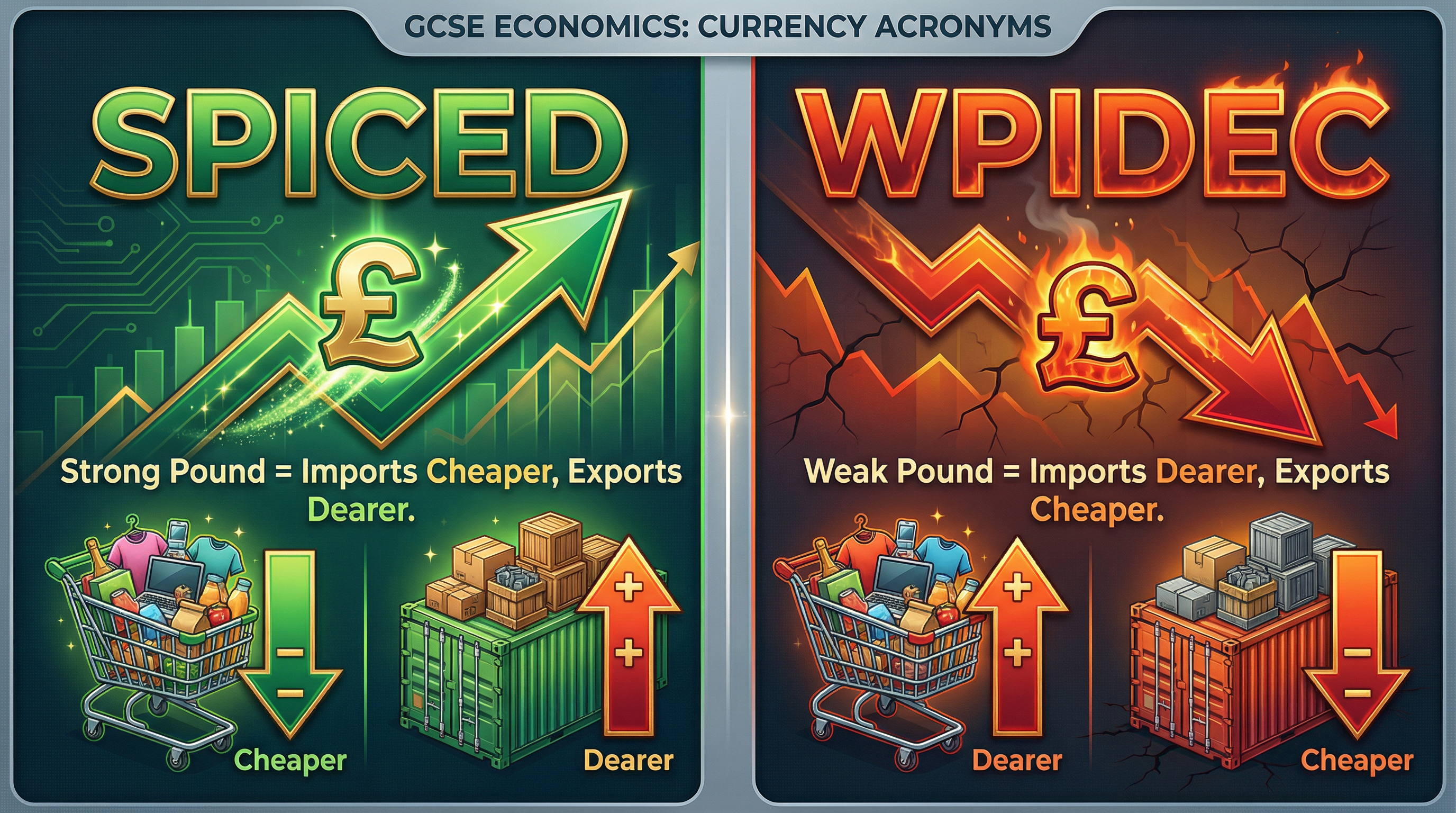

Examiners require you to analyse the consequences of a changing currency value for different economic agents. The acronyms SPICED and WPIDEC are essential memory hooks here.

SPICED: A Strong Pound

A strong pound (appreciation) means that £1 can buy more of a foreign currency.

- Strong

- Pound

- Imports

- Cheaper

- Exports

- Dearer

| Economic Agent | Impact of a Strong Pound (Appreciation) |

|---|---|

| Consumers | Positive. Imports are cheaper, so the price of foreign goods (e.g., electronics from China, food from the EU) falls. This increases consumers' real income and purchasing power. It also makes holidays abroad cheaper. |

| Firms (Importers) | Positive. Firms that rely on imported raw materials or components (e.g., a car manufacturer importing steel) will see their costs of production fall. This can lead to higher profit margins or lower prices for consumers. |

| Firms (Exporters) | Negative. UK exports become more expensive for foreigners to buy. This reduces their price competitiveness and can lead to a fall in export sales, potentially causing lower profits and job losses in exporting industries. |

| The UK Economy | Mixed. Lower import prices can help reduce inflationary pressure (cost-push inflation). However, a fall in net exports (exports minus imports) could worsen the Current Account of the Balance of Payments and lead to slower economic growth. |

WPIDEC: A Weak Pound

A weak pound (depreciation) means that £1 can buy less of a foreign currency.

- Weak

- Pound

- Imports

- Dearer

- Exports

- Cheaper

| Economic Agent | Impact of a Weak Pound (Depreciation) |

|---|---|

| Consumers | Negative. Imports are more expensive, increasing the price of foreign goods and services. This can lead to cost-push inflation, reducing real incomes. Holidays abroad become more expensive. |

| Firms (Importers) | Negative. Firms importing raw materials face higher costs, squeezing profit margins and potentially leading to higher prices for domestic consumers. |

| Firms (Exporters) | Positive. UK exports become cheaper and more price-competitive in foreign markets. This can lead to a significant increase in export volumes, boosting revenues, profits, and potentially creating jobs. |

| The UK Economy | Mixed. Higher import prices can fuel inflation. However, a rise in net exports could improve the Current Account of the Balance of Payments and stimulate economic growth and employment, particularly in manufacturing and tourism (as more foreigners visit the UK). |

Evaluation: The Role of Elasticity

For top marks in evaluation (AO3), you must consider the Price Elasticity of Demand (PED) for exports and imports. The impact of a currency depreciation on the trade balance isn't automatic.

- If demand for UK exports is price inelastic (PED < 1), a fall in their price will only cause a small increase in the quantity sold. This means the total value of exports might actually fall.

- Similarly, if UK demand for imports is price inelastic (e.g., for essential goods like oil or specific medicines with no substitutes), a rise in their price won't significantly reduce the quantity we buy, leading to a much larger import bill.

This is known as the J-Curve Effect: after a depreciation, the trade balance often gets worse before it gets better, as it takes time for consumers and firms to adjust their behaviour to the new prices. Mentioning this shows a sophisticated level of understanding.

Synoptic Links

Exchange rates don't exist in isolation. They connect to multiple other areas of the OCR specification:

- Inflation: A depreciating currency causes cost-push inflation as import prices rise. This links directly to the causes of inflation and the Bank of England's inflation target of 2%.

- Balance of Payments: Exchange rate changes directly affect the Current Account. A weak pound can improve the trade balance by making exports more competitive, but only if demand is price elastic.

- Interest Rates and Monetary Policy: The Bank of England's Monetary Policy Committee sets interest rates to control inflation, but this also influences the exchange rate via hot money flows. There is a trade-off: raising rates to reduce inflation may cause the pound to appreciate, harming exporters.

- Unemployment: If a strong pound reduces export competitiveness, firms may cut production and lay off workers, increasing unemployment in export-dependent regions.

- Economic Growth: Net exports (X - M) are a component of Aggregate Demand (AD = C + I + G + (X - M)). A depreciation that boosts net exports can stimulate economic growth.

Named Example Bank

-

The 2016 Brexit Referendum: Following the vote to leave the EU, the pound depreciated sharply from approximately £1 =

1.48 to £1 = 1.22 within months. This made UK exports cheaper and imports more expensive, contributing to a rise in inflation to 3% in 2017. -

Bank of England Base Rate Changes: In December 2021, the Bank of England raised the base rate from 0.1% to 0.25%, the first increase since the pandemic. This attracted hot money inflows and contributed to a modest appreciation of the pound.

-

Nissan in Sunderland: When Nissan invested in its Sunderland plant, it had to convert Yen into Pounds, increasing demand for the pound. This is an example of Foreign Direct Investment (FDI) affecting the exchange rate.

-

The 1992 Black Wednesday Crisis: The UK was forced to withdraw from the European Exchange Rate Mechanism (ERM) when it could no longer maintain the pound's value. The pound depreciated by 15%, but this eventually improved the UK's export competitiveness.

-

Oil Prices and the Pound: The UK imports a significant amount of oil priced in US Dollars. When the pound depreciates against the dollar, the cost of importing oil rises, increasing costs for transport firms and contributing to cost-push inflation.